defer capital gains taxes without a 1031 exchange

Ensure your contributions are received and processed by the IRS deadline. State Tax Rate 123.

Web Congress and the IRS allow real estate owners to defer capital gains through Section.

. Web A 1031 exchange allows real estate investors to swap one investment. Web A 1031 Exchange is defined under section 1031 of the IRS code as a strategy that allows. Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs.

Web Like a 1031 Exchange the DST can be used to defer capital gains taxes. Create Your Free Investor Account. Investment-grade Real Estate Offerings.

Web For example the IRS allows the use of mineral rights in an exchange as. Web A straightforward 1031 wont produce any income or give your bank. Web Louis Appignani 88 a retired entrepreneur from Miami purchased his first.

5 Ways to Connect. Sovos combines tax automation with a human touch. Web Tired of tenants toilets and trash and dont want to purchase another income property.

Schwab Charitable makes charitable giving simple efficient with a donor-advised fund. Web Quite often owners of investment properties feel very stuck. Web A 1031 exchange also referred to as a Starker exchange or like-kind exchange is an.

More than simply software Sovos wants to be your end-to-end partner in tax compliance. Reach out to learn how we can help you. Web A 1031 exchange comes with a few advantages including deferring.

Web Like a 1031 Exchange the DST can be used to defer capital gains taxes. Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs. 1 To put it.

Learn How to Harvest Losses to Help Reduce Taxes. Web If the 1031 Exchange company sends his money to him he taking. Find Examples of Fully Subscribed 1031 Exchange Properties Listings Here.

Web A 1031 exchange is a legal way for investors to defer their capital gains. Down Markets Offer Big Opportunities. Learn How to Harvest Losses to Help Reduce Taxes.

Web A Section 1031 exchange also known as a like-kind exchange allows. Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Web This taxation is deferred indefinitely while you have ownership of the property.

Web Without the 1031 exchange as vehicle for tax deference the capital. Analyze Portfolios For Upcoming Capital Gain Estimates. Web 2 days agoA 1031 exchange is a tax-deferred exchange of property used for.

Web The term 1031 Exchange is defined under section 1031 of the IRS Code. Review Your Case - Gather The Evidence - Confront The Entities - Get Your Money Back. Diversify Your Real Estate Investments.

Down Markets Offer Big Opportunities. Web The 1031 tax-deferred exchange is a method of temporarily avoiding. Web A 1031 exchange allows an investor to sell a real estate asset and purchase a like-kind.

Own Real Estate Without Dealing With the Tenants Toilets and Trash. Were a team of legal professionals who assist scammed traders in recovering stolen funds. Web Surface Studio vs iMac Which Should You Pick.

Are You In 45 Day Period.

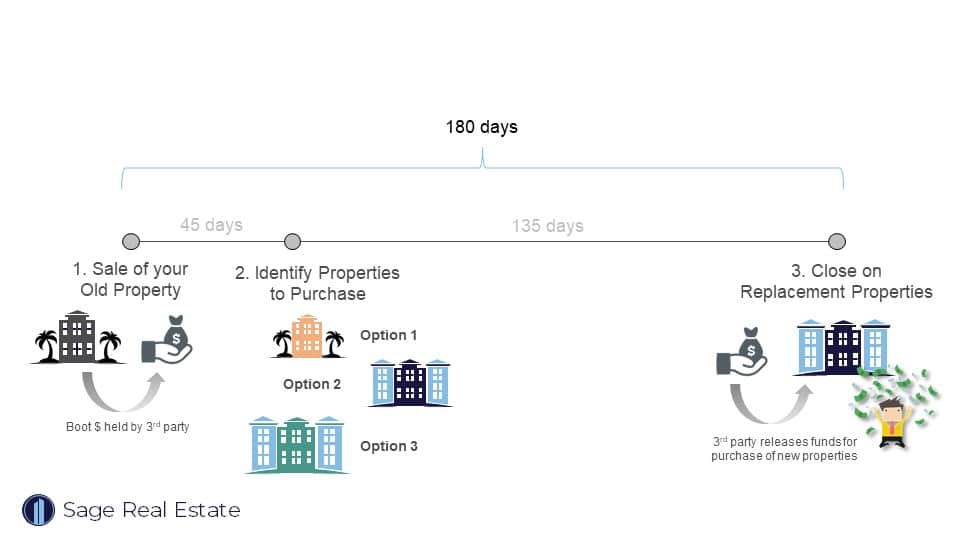

1031 Exchange Timeline How The Irs 1031 Exchange Process Works

Defer Capital Gains Taxes Online Webinar With Or Without A 1031 Exchange November 10 2022 Online Event Allevents In

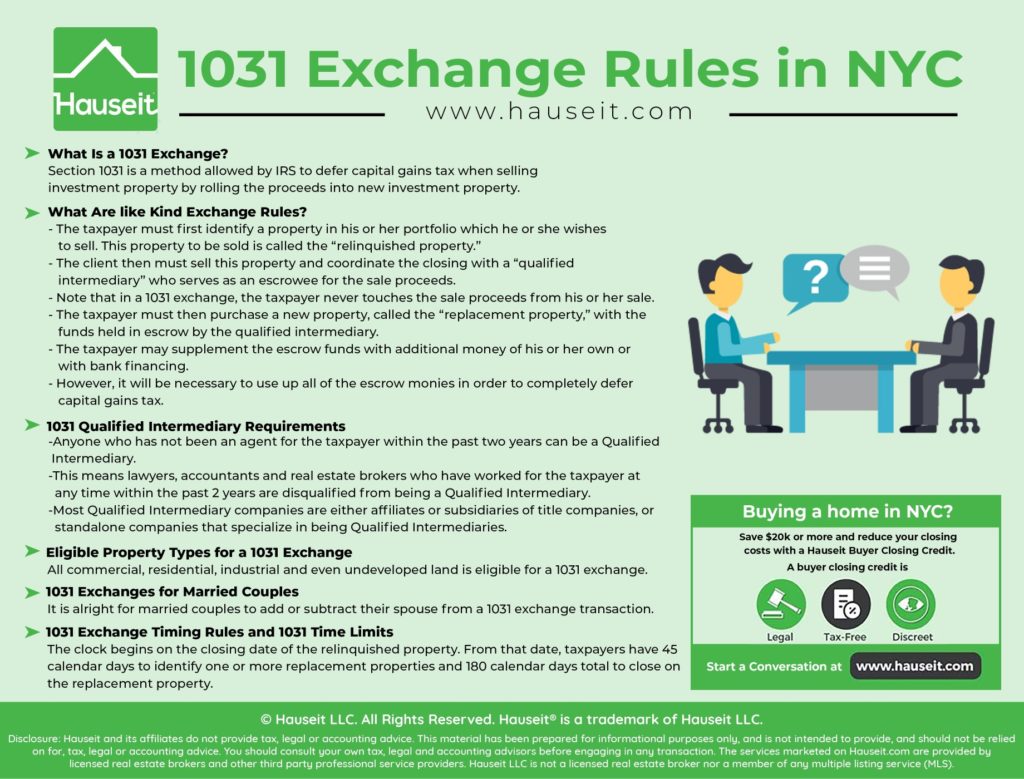

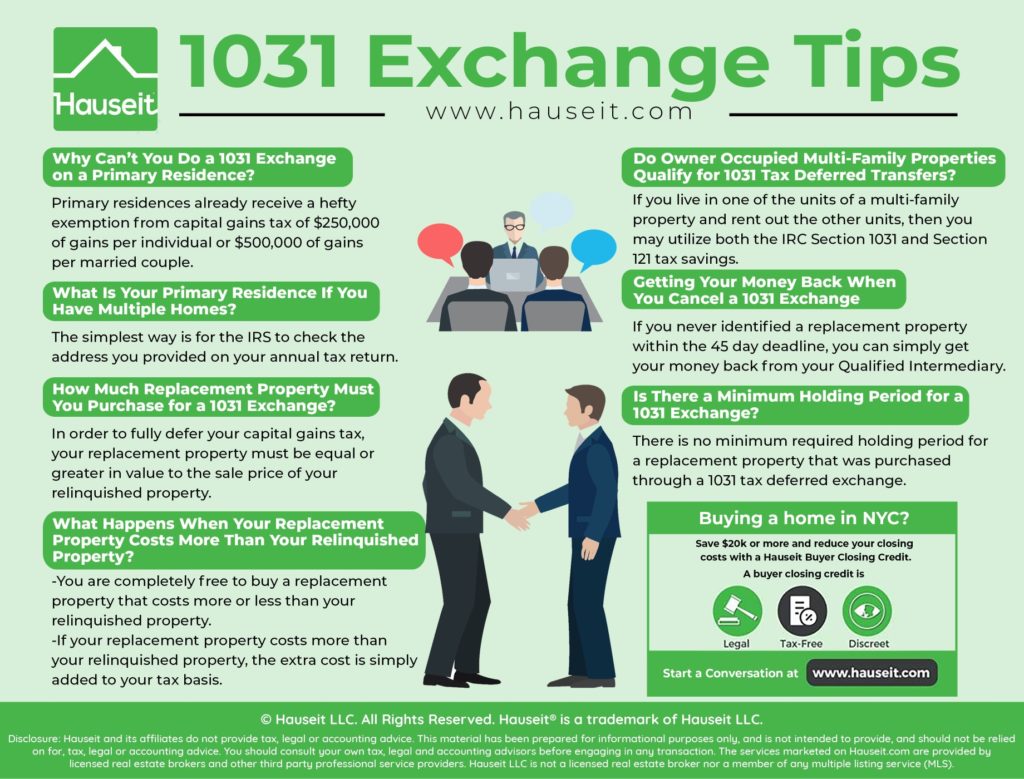

How To Do A 1031 Exchange In Nyc Hauseit New York City

Stream Ep 97 1031 Exchanges How To Defer Capital Gains Tax On Properties By Live Off Rents Podcast Listen Online For Free On Soundcloud

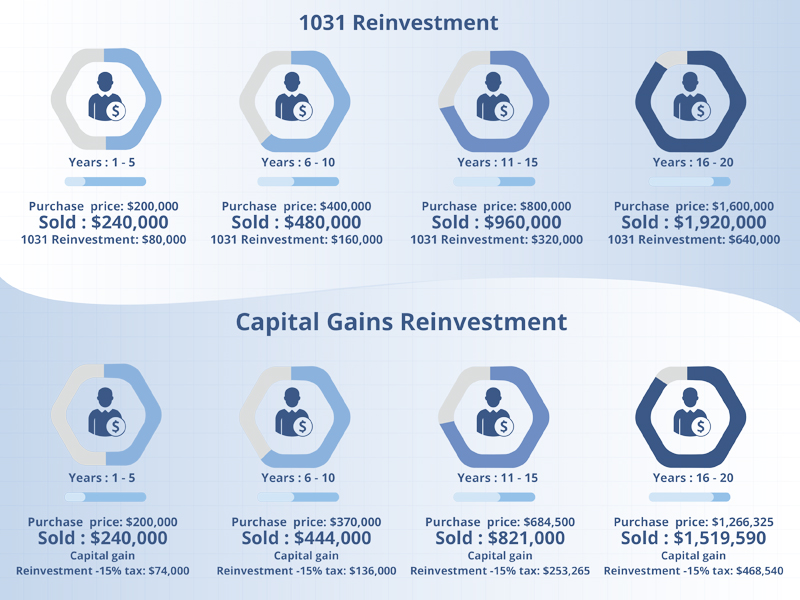

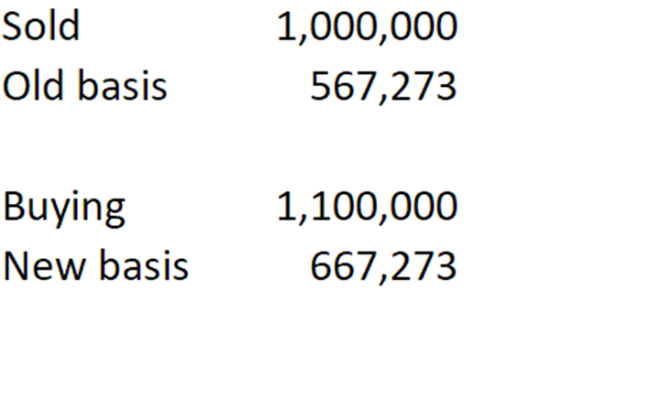

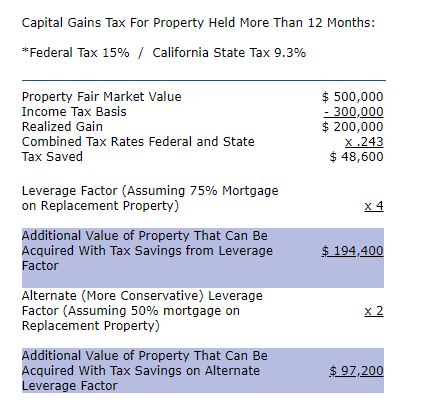

Deferring Capital Gains Through A 1031 Exchange

1031 Exchange Defer Or Sell Pay Taxes Ipx1031 National Leader

1031 Exchange Rules 2021 What Is A 1031 Exchange

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

How The 1031 Exchange Can Turn Deferred Tax Into A Real Estate Empire

How To Do A 1031 Exchange In Nyc Hauseit New York City

Deferring Capital Gains Taxes In Real Estate With A 1031 Exchange Everything You Need To Know Sage Real Estate

1031 Exchange The Ultimate Guide Jrw Investments

State To State 1031 Exchange Rules On Capital Gains Taxes

1031 Exchange Guide For 2021 1031 Exchange Rules

New Page Marin County Exchange Corporation

What Is A 1031 Exchange Asset Preservation Inc